🗒️ Crypto VC Pantera Capital Looks to Raise $1.25B for Second Blockchain Fund: Report

Coindsk: Crypto venture capital investor Pantera Capital is looking to raise $1.25 billion for its second blockchain fund, Bloomberg reported on Wednesday.

Pantera founder Dan Morehead said at a conference in Singapore that the fund will invest in digital tokens and equity, including shares in company Pantera already owns which have dropped in value.

The crypto industry has been treading water in recent months following its crash in mid-June. The market cap of the crypto market has been fluctuating below the $1 trillion mark since while the traditional markets are also experiencing turmoil.

“We want to provide liquidity for people that are kind of giving up because we’re still very bullish for the next 10 or 20 years,” Morehead said.

🗒️ Scale Venture Partners closes $900M for fund to back software startups

Techcrunch: Money continues to flow into new venture capital funds. For example, in the past month, Runa Capital, Lerer Hippeau, Razor’s Edge Ventures, First Star, OurCrowd, Northzone, Janngo Capital and Kapor Capital all announced new funds.

Now it’s Scale Venture Partners’ turn, announcing it secured $900 million in committed capital for its eighth fund, also its largest since forming in 2000. The fund was raised in 120 days over the summer, partner Rory O’Driscoll told TechCrunch.

Known for backing enterprise software, the firm was an early investor in some legacy SaaS companies, including Box, DocuSign, HubSpot, RingCentral and Bill.com. It’s also invested in younger companies, like BigID, Dusty Robotics and Honeycomb.

The timing of the new fund is about right for the firm, which has raised a new fund every two years since 2016, according to O’Driscoll.

🗒️ Cathie Wood's New Venture Fund Offers Access to Hard-to-Trade Assets for Just $500

Bloomberg: Cathie Wood’s ARK Investment Management has launched a new fund that will give almost any investor easy access to harder-to-trade assets -- though with a limit to how quickly they can cash out.

The firm on Tuesday announced that its long-awaited ARK Venture Fund is now available to all US investors via an investing app called Titan. The fund, which carries a minimum investment of just $500, will target mostly private companies focused on tech-powered innovation, as well as some public firms and other venture capital funds.

The ARK Venture Fund has been in the cards since February, when an initial filing revealed plans for a closed-ended “interval” product that would take Wood’s flagship strategy into these less-liquid assets. Interval funds are structured to give investors less control over how and when they can pull out their money. Up to 5% of the net asset value of the venture fund can be redeemed by investors every quarter.

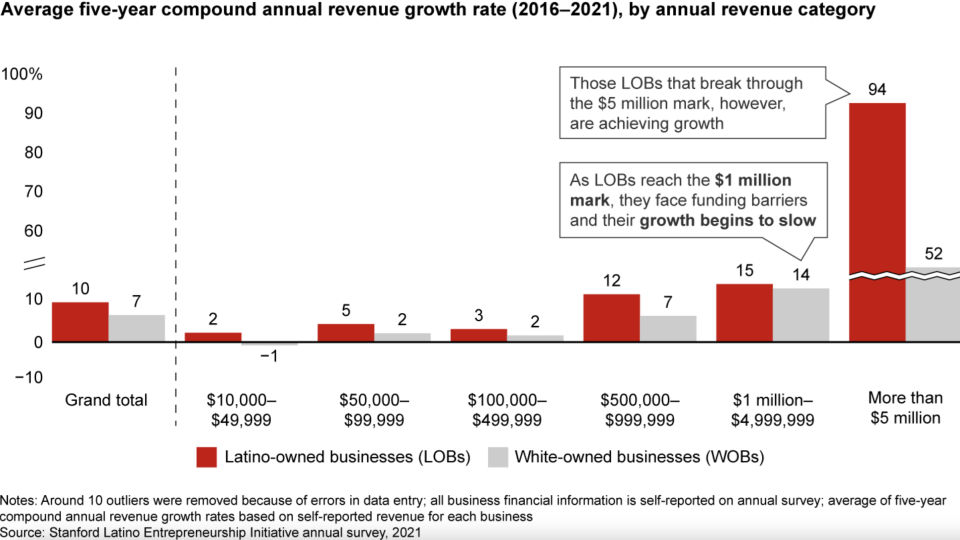

🗒️ Latino-founded startups still have the ‘most difficult time’ raising capital, L’Attitude Ventures’ Sol Trujillo says

Yahoo Money: Latinos are a fast-growing segment of the U.S. population, yet startups run by Latino entrepreneurs still struggle with structural obstacles, particularly funding and the ability to scale.

“It is the Latino entrepreneur that has the most difficult time of any cohort in the United States to access capital,” Sol Trujillo, founder and general partner of L’Attitude Ventures and chairman of Trujillo Group, told Yahoo Finance at the L’Attitude conference (video above).

There’s a clear disconnect between the growing Latino population and the attention paid to its entrepreneurs by the venture capital and private equity sector. The Latino population has grown 23% overall over the past decade outpacing the nation’s 7% overall population growth, according to a Pew Research Center analysis, while money going to Latino founders has barely increased over the past five years.