🗒️ Family offices move money out of stocks and into private markets

CNBC:

-

Family offices now have more of their money invested in private markets than the public stock market — even as the market rallies.

-

The new survey results underscore a sweeping shift in the investment practices of family offices, the private investing arms of families with assets typically of $100 million or more.

-

Along with private markets, family offices are also showing increasing interest in alternative assets, including real estate and commodities.

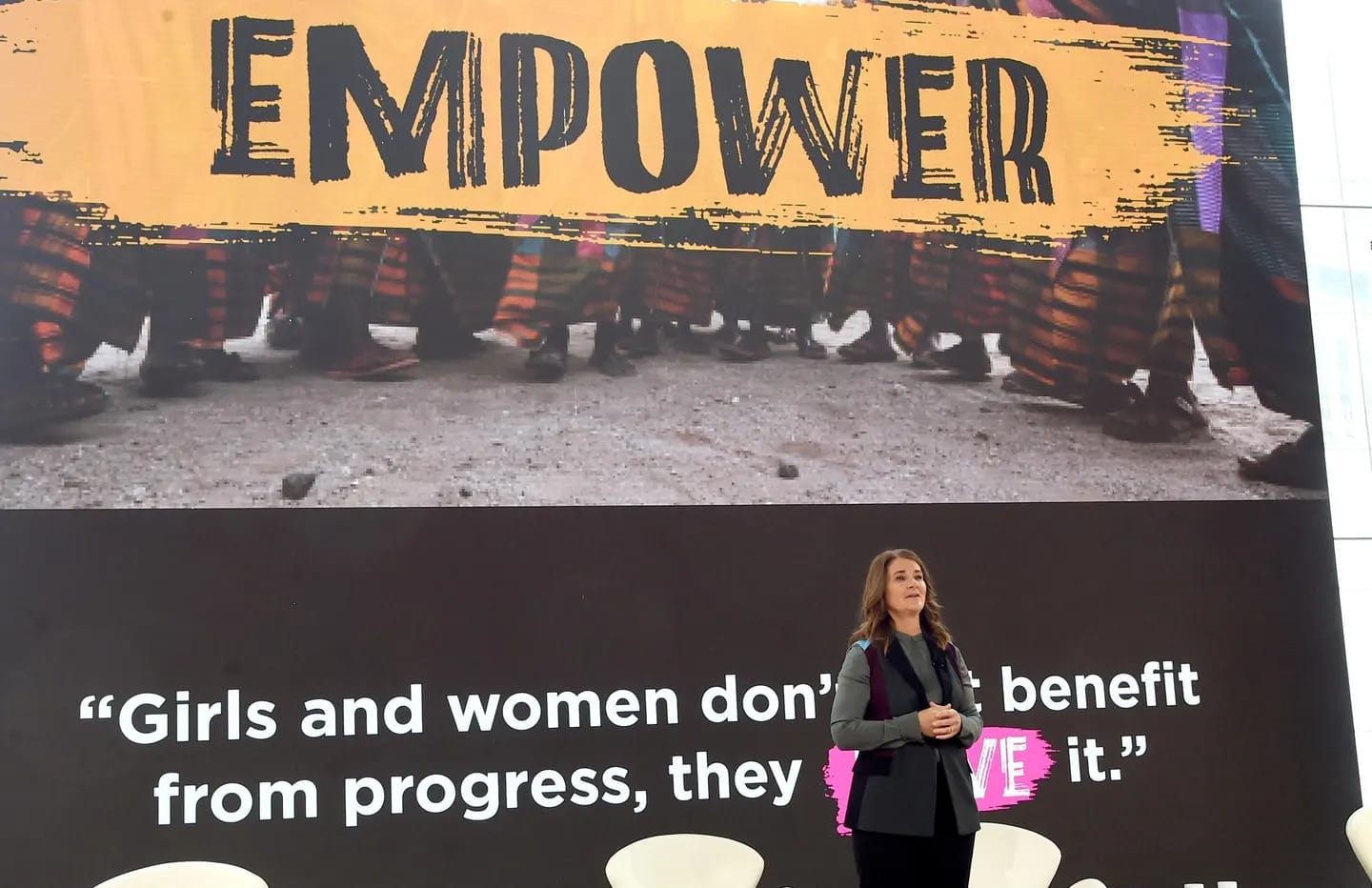

🗒️ Empowering Women Entrepreneurs: 5 Strategies For Melinda French Gates To Transform VC

Forbes: Melinda French Gates has set her sights on a formidable task – reshaping early-stage venture capital (VC) to better serve women entrepreneurs. Given that VCs cater to a select few, fail on about 80%, and need home runs to pay for the failures, the question looms: can Gates make a dent and leave a legacy? Or will she join a long line of well-meaning VC benefactors with loads of good intentions but without a foundational understanding of VC outside the narrow confines of Harvard, Stanford, and Silicon Valley?

🗒️ Why 2024 could be a hot year for startup founders

Techcrunch: If you are building a startup you might wish that 2021 were here again. So much capital flowed around the world that many young tech companies were able to raise several times in the span of a single year, unicorn births were announced by the dozen, and IPOs were hot. The ensuing multi-year downturn has proved a sober reminder that the business cycle is just that.

But if what goes up must come down, then what goes down must come up? Maybe, maybe not, but 2024 is looking like a much better year for tech startups than what they were forced to endure in 2022 and 2023. Why? Three core reasons: Many tech companies are expecting a growth rebound next year, venture capital totals could bounce off 2023-era lows, and the IPO market could defrost itself.

🗒️ Showing signs of a resurgence, pre-seed investment market defies broader downturn

SiliconAngle: A new report released today by early-stage venture capital fund Forum Ventures LLC has found a slight resurgence in the pre-seed investment market even as late-stage venture capital investments continue to grapple with a broader downturn.

The Forum Ventures’ second annual State of VC Market report was compiled by surveying 70 U.S. venture capital funds, including Outsiders Fund Management LLC, High Alpha Capital Management LLC, Outbound Capital Management LLC, Female Founders Fund LLC and Right Side Capital Management LLC. The survey was conducted over two weeks in early November and also collected data on 158 pre-seed rounds that closed in 2023.

The report found that the majority of companies receiving investment were based in major tech hubs such as New York City and the San Francisco Bay Area, with each location accounting for 19.6% and 24% of investments respectively. Financial technology, generative artificial intelligence and the future of work were the most popular industries for investment.

Top 3 book summaries this week 📚

Fanatical Prospecting by Jeb Blount

After Facebook, Twitter, and LinkedIn arrived on the scene, there as a lot of hope that the profession of sales would be changed forever. No longer would a salesperson have to pick up the phone and cold-call prospects. After all, all of those old school sales tactics don’t work anymore, right? Wrong. Jeb Blount is here to tell us that not only do the same techniques that have always worked still produce re-sults, they might produce even more today because so many of your competitors are off chasing the latest bright shiny object.

Onward by Howard Schultz

When Howard Schultz set out on business, it was not his objective just to make money. He wanted to build a great, enduring company: a balance between revenues and relationships. The result we all know was Starbucks. However, the Starbucks journey has not always been positive. An obsession on growth tainted the company over time and Starbucks lost its sparkle. In his biographical book, Onward, Schultz shares with us the challenges he faces and actions taken to rein-state the third place in our lives. So, in less time than it takes to enjoy a skinny, extra hot caramel macchiato, join us to find out how we can learn from Starbucks soul-saving steps.

Wooden on Leadership by John Wooden

“Am I the biggest? The best? The fastest?” These are questions that basketball Coach John Wooden suggests we avoid as leaders. While we all would like to get positive answers to these challenges, Wooden suggests they are actually detrimental to being a great leader. So what should we do? Wooden offers us his Leadership Pyramid: Fifteen progressive characteristics that he applied throughout his lengthy NBA career that describe his key facets of leadership. Join us for ten minutes to find out the building blocks for leadership success.