🗒️ Impact X-Venture Studio: Microsoft’s drive to accelerate underrepresented tech startups

Microsoft: With more unicorns than France and Germany combined, the UK has no shortage of innovative entrepreneurs. Yet investment remains a challenge – particularly for founders from minority groups. That’s why Impact X — a venture capital firm founded to support underrepresented entrepreneurs across Europe — is partnering with Microsoft to launch the Impact X-Venture Studio.

The initiative will make tools and funding available for startups to help them accelerate their companies. Sustainability is a key focus, and the Impact X-Venture Studio is collaborating with Spring Innovation, the water sector’s centre of excellence. Spring Innovation’s mission is to accelerate transformation across the water industry.

By connecting the expertise and skills of Impact X, Microsoft and Spring Innovation, Impact X-Venture Studio hopes to achieve three core things: unlock the potential of tech startups, at scale; help tackle the most pressing challenges the water sector is facing; and ensure fairer representation of minority groups in the start-up space. And hopefully find a unicorn in the process.

🗒️ Billionaire VC Investor Marc Andreessen Explains How His Firm Invests in the Crypto Space

Cryptoglobe: Marc Andreessen, co-founder and general partner at Silicon Valley based venture capital firm Andreessen Horowitz (“a16z”) recently explained how his firm invests in the crypto space.

Andreessen Horowitz, which was founded in 2009 by Marc Andreessen and Ben Horowitz, is a venture capital firm that “backs bold entrepreneurs building the future through technology.” It claims that it is stage agnostic, investing in “seed to venture to late-stage technology companies, across bio + healthcare, consumer, crypto, enterprise, fintech, games, and companies building toward American dynamism.” a16z has “$35B in assets under management across multiple funds.”

🗒️ Female Entrepreneurship Continues Expansion Into Previous No-Fly Zones

Forbes: Entrepreneurship programs for the ascending generations continue to extend into K-12 and higher education. Once positioned as education flybys, these efforts are now finding footing in sustained curriculum and career paths.

True to the notion that entrepreneurs often build their dream businesses while the plane is attempting to fly, those female business owners or early adopters have had to chart a course without direction and sometimes defined paths.

Female entrepreneurs in sectors that men have historically dominated have stretched the research sector looking for both clues and answers.

🗒️ Largest QOFs Continue to Raise Majority of Equity; ‘Super QOFs’ Keep Increasing

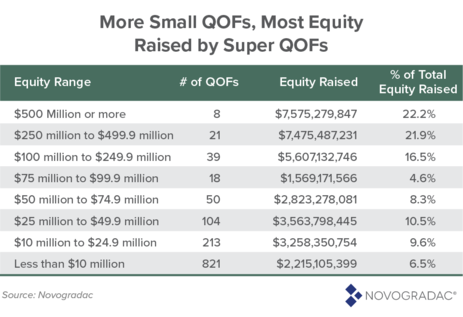

Novogradac: Qualified opportunity funds (QOFs) that have raised $100 million or more in equity accounted for 61% of all equity raised by QOFs tracked by Novogradac at the end of 2022. That continued a trend of a minority of QOFs (in this case, the 5.3% of all QOFs for which Novogradac reports an equity amount that have raised $100 million in equity or more) raising the majority of equity for investment in opportunity zones (OZs).

QOF tracked by Novogradac reported $34.09 billion in equity raised as of Dec. 31, 2022–a record $9.68 billion of that in 2022 alone. Of the 1,661 QOFs tracked by Novogradac, 1,274 reported an amount of equity raised and of those, 68 raised $100 million or more–a cumulative $20.7 billion.