🗒️ How VCs’ lack of succession planning is leaving big firms without a future

Sifted: From the monarchs of yore to today’s global CEOs — leaders have always had succession on their minds. Even more so today; the average CEO is only around for five years.

Yet for many VCs, the topic remains taboo.

As the industry expands — funding for European startups quadrupled from 2017 to 2022 to reach $94bn — VCs will have to start succession planning if they want to keep their firms running for another 40, 50 or even 100 years. Some older US VC firms have already transferred leadership successfully, but many European firms still haven’t thought about who will take the reins when the original partners check out.

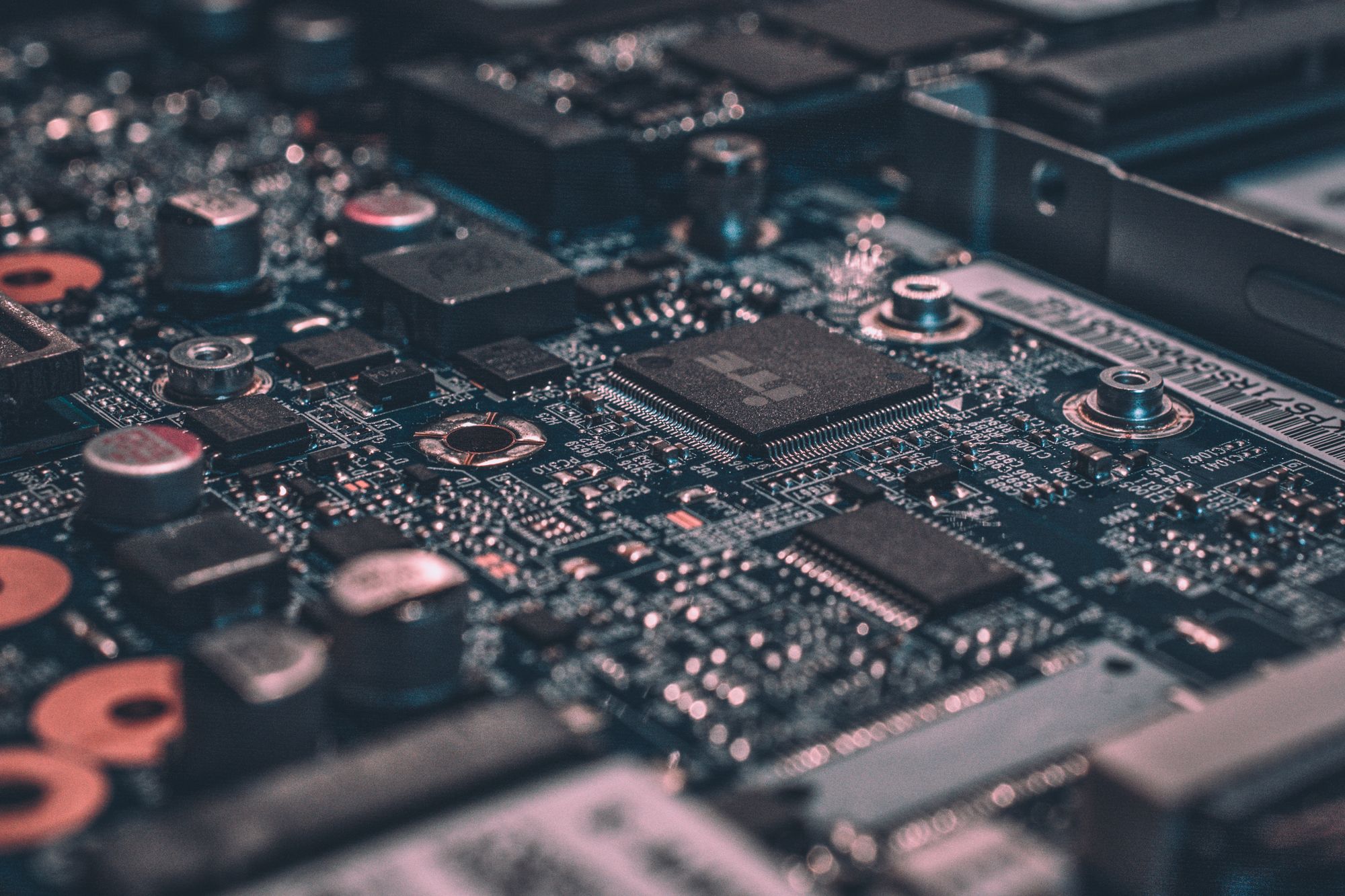

🗒️ Technology diffusion strategies for CIOs and the VC mindset

Techtarget: Venture capital thinking was a matter of geographical destiny for Samsara, an industrial IoT company with headquarters in San Francisco.

"We naturally kind of take on this VC mindset," said Stephen Franchetti, CIO at Samsara. "We live in an area of the country where there are a lot of VCs focused on emerging technologies, so relationships with those VCs and networks of other CIOs become really important."

Familiarity has bred success in Samsara's case. Meeting periodically with VCs, and other external partners, helps the company stay on top of fields from security to AI, Franchetti noted. Discussions with VCs also help Samsara understand which startups in an investor's portfolio best suit its needs. This helps populate an ideation funnel, consisting of startups and technology approaches. The company can then select the most promising offerings for its business needs and prepare for initial testing and technology diffusion -- the process by which a technology spreads within an enterprise.

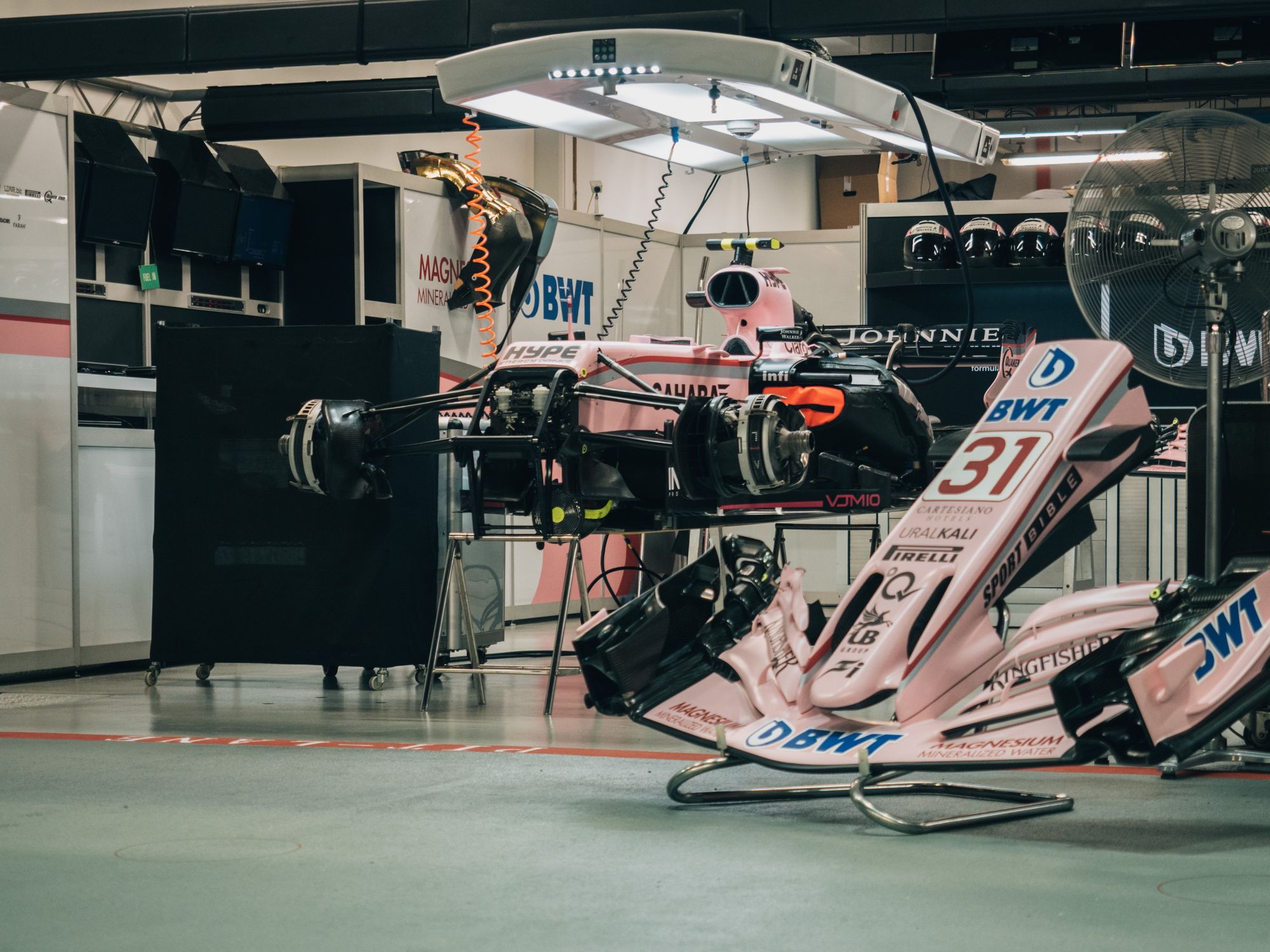

🗒️ Why Corporate Venture Capital Is Changing -VC Mike Edelhart

Forbes: To kick off this week's issue, I invited my old friend Mike Edelhart to share some insights from the front lines of venture capital. Mike is managing partner of Ataraxia, an early-stage fund focused on helping people live longer and live better, along with leading the Joyance Partners and Social Starts venture capital partnerships. Some of you may know him as the original Executive Editor of PC Magazine or as CEO at several startups, including Olive Software, Inman News, and Zinio. Here's Mike:

"Before I got into venture capital, when I still worked with big companies, the worlds of venture and corporate management stood well apart from one another. That’s no longer the case. Most large companies now invest in new ventures, often through their internal corporate venture capital (CVC) arm.

If you’ve worked with CVCs–on the corporate side, as a partner or as a venture that’s received such funding–you probably already know that the record is mixed. There are a lot of reasons for this. Early-generation CVCs stuck close to their company HQ and strategy, often missing market pivots and using a dated script to measure a startup’s potential. Their metrics may be muddled by other priorities. Some treat CVCs as a backdoor way to do M&A. Others use it as a way to dabble in a new area or connect with the cool kids starting companies. There’s the challenge of partnering the big with the small. Unlike traditional venture capitalists, CVCs rarely risk their own money. Some are not even pressured to make money. In other words, they’re not really venture capitalists.

🗒️ Buy or build? How to make the best decision in an economic downturn

Venture: This article is part of a VB special issue. Read the full series here: The CIO agenda: The 2023 roadmap for IT leaders.

The economic downturn is here. From Alphabet to Meta and Amazon, Big Tech companies have led the news with substantial layoffs.

“In this new environment, we need to become more capital efficient,” Mark Zuckerberg said when announcing the plan to let go of 11,000 employees in November 2022. “We’ve cut costs across our business, including scaling back budgets, reducing perks and shrinking our real estate footprint.”

But enterprises across sectors are responding to the uncertain environment with a renewed focus on efficiency, productivity and resiliency. They’re cutting costs, laying off employees and narrowing in on priority projects.

With much of the attention on reducing cash burn, questions about technology investments have become ripe. Some think IT spending will take a hit (just like everything else), while others predict it will be recession-proof as technology is essential to every business and executives may increase spending on digital business initiatives to drive growth. Gartner, for instance, estimates IT spending will grow 5.1% to $4.6 trillion in 2023.