🗒️ Andreessen Horowitz is now openly courting capital from Saudi Arabia, despite U.S. strains

Techcrunch: Andreessen Horowitz is now openly courting capital from Saudi Arabia, despite U.S. strains.

According to Bloomberg, Marc Andreessen and Ben Horowitz appeared on stage with WeWork co-founder Adam Neumann to talk for at least the second time since November about their firm’s $350 million investment in Flow, which is Neumann’s new residential real estate company. Their choice of venue was intentional: the conference was organized by a nonprofit backed by one of Saudi Arabia’s largest sovereign funds, and Flow may launch in the Kingdom, says Bloomberg. Meanwhile, the three reportedly laid it on thick, with Horowitz praising Saudi Arabia as a “startup country” and saying that “Saudi has a founder; you don’t call him a founder, you call him his royal highness.”

Said Neumann separately: “It’s leaders like his royal highness that are actually going to lead us where we want to go.”

We reached out to Andreessen Horowitz with related questions this morning and have yet to hear back.

🗒️ Rich families skimp when it comes to cybersecurity, and it can cost them millions

Business Insider:

- More than one-third of family offices had at least one cyberattack in 2022.

- Firms that serve the wealthy spend too little to fend off email hacks and ransomware.

- Insider spoke to EY about why the rich skimp on security and how they can protect themselves.

When it comes to fending off hackers and other cyber threats, the world's richest people can be surprisingly stingy.

Many set up family offices to manage their affairs with these firms ranging from hedge-fund-esque vehicles with chief investment officers to small operations with a few employees who handle bill pay. Analysis of North American families by Campden Wealth found that, on average, offices held about $2 billion in assets but spent only $48,000 on cybersecurity.

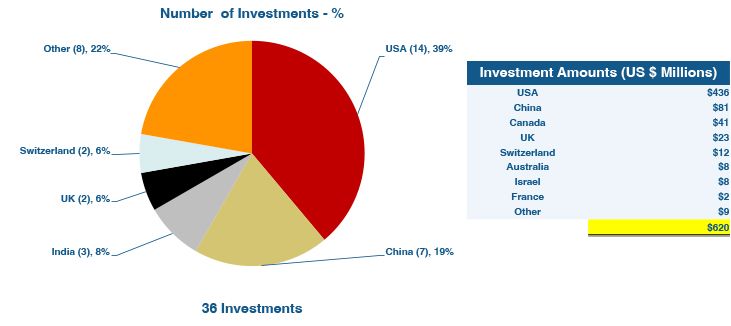

🗒️ Robotics investments reach $620M in February 2023

The Robot Report: Robotics funding for February 2023 totaled $620 million as the result of 36 investments. See Table 1 below or download Table 1 here. The February investments bring the 2023 total to approximately $1.14B. Investments in January 2023 totaled $521 million.

Companies offering unmanned aerial drones, usually coupled with drone-enabled data and analytics services, were particularly strong in February 2023, with firms receiving sizable mid- to late-stage funding rounds. These providers typically focus on surveying and inspection applications, with construction, agriculture, utilities and energy sectors as the target markets. Examples include Skydio ($230M Series E), Fulfil Solutions ($60M Series B), Garuda Aerospace ($22M Series A) and i-KINGTEC ($20M Series C). UK-based DRONAMICS landed $40M in Seed funding.

🗒️ VC dealmaking in climate tech slows dramatically

Pitchbook: VC funding for climate tech startups has slowed to its lowest pace in nearly three years, a worrying sign for an industry which had, until recently, brushed off the tech market downturn.

In Q1, climate tech startups raised $5.7 billion across 279 VC deals, according to PitchBook data. That's a 36% decline in deal value and a 31% decline in deal count from the previous quarter. From its peak in Q3 2021, quarterly deal value has fallen more than 50%.