🗒️ This New Platform Makes Millionaire-Style Startup Investments Accessible to Everyone — Sweater's New 'Public VC Funds' Allow Anyone To Create A Venture Capital Fund

Benzinga: Fintech company Sweater is set to unveil its latest innovation — Public VC Funds. The revolutionary platform breaks down long-standing barriers in the venture capital (VC) industry, opening doors for regular individuals to invest in VC funds.

For over half a century, VC funds have been reserved for wealthy investors with substantial net worth or high incomes. Sweater's new offering disrupts this exclusive tradition, enabling any institution or individual to launch their own VC fund and invite the general public to participate, regardless of accreditation status.

🗒️ European VCs see exodus of women investors

Sifted: Annalise Dragic was made partner at Sapphire Ventures in 2021, at the age of just 29, with huge fanfare — one of the youngest ever female partners of a European VC firm.

But now, Sifted understands, she will soon be leaving the firm — one of the dozens of women who have quit the VC industry in Europe since the start of this year, a worrying trend for an industry already struggling with diversity.

The women are mostly at more junior investing levels such as principal and associate, although several partners have also stepped down this year, including Dragic and Cleo Sham at Stride. Though the numbers aren’t large, they are significant, recruiters say, given the small size of the industry.

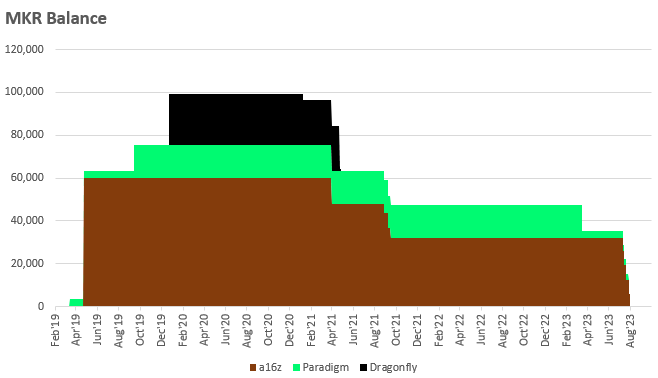

🗒️ VC Giants Selling MakerDAO Balances a Big Plus for MKR Bulls

Be In Crypto: Venture capital companies have been offloading their balances of MakerDAO’s MKR token. This scenario would put downward pressure on token prices, but it is actually a big plus for protocol decentralization and future price action.

Researchers have been delving into the balances of MakerDAO tokens by venture capital giants such as Andreessen Horowitz (a16z).

MakerDAO Steps Towards Decentralization

On Aug. 1, Menya Research analysts reported that a16z is finally selling the last of its MakerDAO balances. Furthermore, VC firms such as Paradigm and Dragonfly have also sold their MKR holdings.

“This selling has been a significant overhang for Maker bulls,” they noted.

🗒️ Nearly Three-Quarters of LPs Plan to Cut Back on VC, Survey Shows

Instutional Investor: In the past year, almost all types of private market funds have encountered fundraising challenges amid deteriorating macro conditions and rising geopolitical concerns. But venture capital funds will have a particularly bumpy road ahead.

While 65 percent of institutional investors said they would increase allocations to buyout funds in 2024, only 13 percent said the same for venture capital funds, according to the latest study from Stifel & Eaton Partners, a capital placement agent and fund advisory firm. Meanwhile, 71 percent of investors indicated that they would allocate less to VC next year. This was far more than the proportion of investors who planned to cut their allocations in any other private equity category: The second-highest was growth equity, with 29 percent of respondents planning to scale back their allocations.

Top 3 book summaries this week 📚

The Coaching Habit by Michael Bungay Stanier

The Coaching Habit covers seven questions that will break you out of the vicious circles of over-dependent teammates, overwhelming amounts of work, and disconnection from the work that matters.

Emotional Agility by Susan David

The hardest thing to manage in business? Your emotions. Susan David is our guide on how to do it well, so we can create a better business and a better life. In this summary we’ll explore what emotional agility is, and how you can develop it in yourself and others.

Never Split the Difference by Chris Voss

Learn the negotiation tactics Chris Voss mastered negotiating with terrorists while at the FBI. This summary explores how you can become a master negotiator by forgetting everything you know about negotiation. You'll never negotiate the same way again.