🗒️ Raising venture capital is about to get more difficult in 2022. 3 founders explain how to fund a business without VC

Business Insider: The Silicon Valley venture-capital firm Y Combinator told startups in its portfolio that raising funds could get difficult this year.

"No one can predict how bad the economy will get, but things don't look good," said the letter, which was titled "economic downturn" and sent to founders planning to raise funding in the next six to 12 months. "The safe move is to plan for the worst."

Y Combinator's letter comes at a time when tech firms are implementing hiring freezes and layoffs because they're anticipating a recession later this year. Venture-capital investments are dropping, too: A May report by Crunchbase News found that the value of VC investments had dropped by $5 billion between March and April.

But raising venture capital isn't the only way to fund a business. Insider spoke with three founders who explained how they successfully started and scaled their companies without venture capital.

🗒️ Six bootstrapped startups that have (so far) shied away from VC

Shifted: Not all European tech startups choose to take investment from VCs. Many decide to finance with other methods: crowdfunding, grants, investment from family or personal money.

Some say that their choice to forego VC investment — for now at least — means they aren’t on the hook to produce the kinds of hypergrowth that VCs look for. And they can instead focus purely on building a sustainable business — some with more than 200 employees.

Here are six startups in Europe that have chosen to pursue alternatives to VC and how they did it.

Click here to read more

🗒️ How a VC Firm Is Using Machine Learning to Attract Portfolio Companies — And Investors

Institutional Investor: As investors enter bear market territory, alternative asset managers will need to differentiate themselves from competitors in ways they haven’t had to in years.

Venture capital firm Georgian may stand out thanks to the machine learning applications it is using to grow its portfolio companies. Benefitting from offerings like these is one of the firm’s most well-known investments: IEX. Short for Investors Exchange, IEX was founded by Brad Katsuyama and Ronan Ryan, who were featured in Michael Lewis’s book, Flash Boys.vv

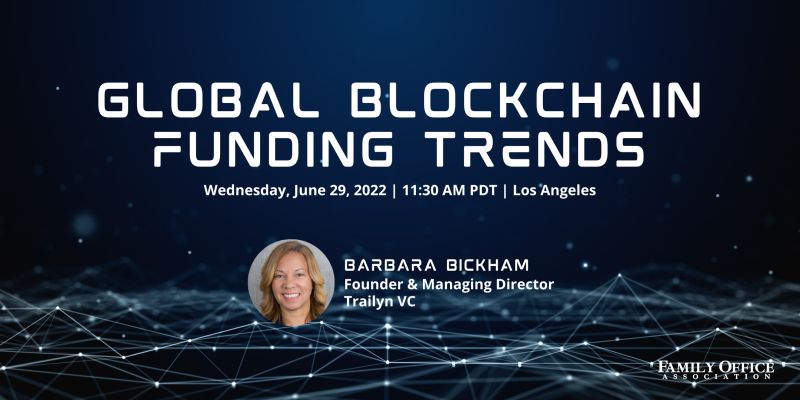

🗒️ Family Office Association - Global Blockchain Funding Trends - Los Angeles, CA - Wed, June 29th @ 11:30 am

Family Office Association: Join us for a Private Salon in Los Angeles on Wednesday, June 29, 2022 at 11:30 AM with speaker Barbara Bickham Founder & Managing Director of Trailyn VC.

Global Blockchain Funding Trends – Barbara Bickham will discuss the rapidly changing Blockchain space. It is still hard to understand the technology. During this session, she will introduce you to blockchains, practical use cases, and global funding trends.

• BLOCKCHAIN 101 - What is a Blockchain?

• BLOCKCHAINS CREATE ECONOMY - How blockchains work similarly to current economies.

• PRACTICAL USE CASES - What are some real-world use cases that are being used now?

• FUNDING TRENDS - Latest Blockchain Funding Trends

If you are a single-family office, family office executive, investor, FOA Member, and Resource Council member, this event is for you.

To RSVP, email Kathleen Tepley at kathleen@familyofficeassociation.com.