🗒️ Bootstrapping or venture capital: Which is the best way to fund startups?

Yourstory: Venture capital investments in India grew four-fold in 2021 from the previous year as India’s startup ecosystem reached an inflection point. According to a YourStory analysis, the VC investments in the country reached a record high of $38.3 billion in FY22, driven by a combination of COVID-19 tailwinds and sound macroeconomic fundamentals, among the major global economies. This year, India surpassed the milestone of 100 startups entering the coveted $1 billion-plus valuation club and becoming unicorns.

In a world of mega-fundraising sprints, many startups prefer to go the steady way and choose the path of bootstrapping. Most startups that prefer bootstrapping are those with the goal of controlled growth that wants to stay in the game for the long haul instead of relying on external funding for accelerating growth quickly.

The current economic situation (of the funding winter) means entrepreneurs across the board are being more frugal, highly innovative, and more focused on acquiring customers without the cash burn.

🗒️ Slumping NFTs Still Have These Big-Money Fans

Bloomberg:

Game for NFTs

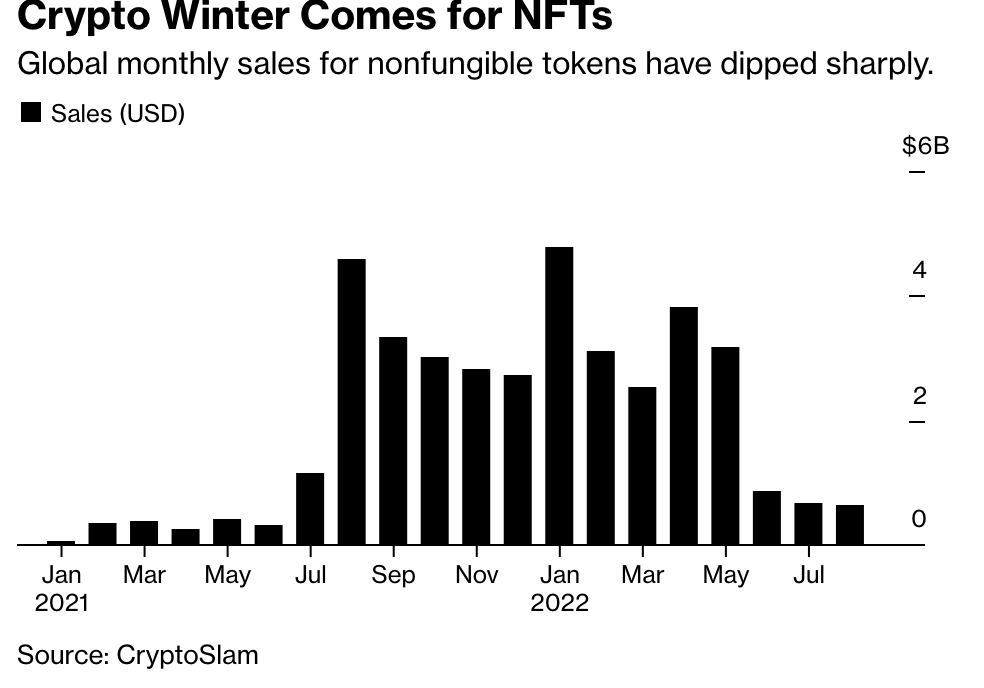

The plunge in crypto prices and blowups of major blockchain projects like Terra have cast a pall over the digital-asset industry; as a result many of the venture capitalists who helped fuel last year’s boom aren’t as free with their money now. In the past few months, they’ve pulled back on funding, leaving some startups with less financing than planned or at lower valuations — or in some cases even unable to seal a deal at all.

There is, curiously, a notable exception: nonfungible tokens. VCs are still bullish on these tokens even as demand for NFTs continues to languish along with the rest of the asset class.

🗒️ Growth Equity Emerges as the Biggest Tech Investor

Institutional Investor: Growth equity investments in technology companies are surging.

In terms of investment in tech, growth equity’s share increased from 19 percent in 2017 to 27 percent in 2021, according to the latest annual technology report from Bain & Company, the management consulting firm. The report found that growth equity funds have expanded their presence in technology faster than venture capitalists, buyout funds, and even public investors.

In the past five years, both venture capital firms and mega-buyout funds have been actively exploring opportunities in mid-stage companies. Growth funds raised a record $102 billion in 2021, up 53 percent from a year before and up 74 percent from the average of the preceding five years, according to Ernst & Young.

🗒️ NEAR protocol spin-off Open Web Collective launches venture arm to invest in early-stage web3

Tech Crunch: Open Web Collective, a blockchain and web3 accelerator, has launched a new division called OWC Ventures to invest in early-stage crypto startups, the team exclusively told TechCrunch.

The division is backed by Barry Silbert’s Digital Currency Group and the blockchain protocol NEAR (from which OWC previously spun out), Jeff Lavoie, head of investments at OWC Ventures, said to TechCrunch.

There will also be a fund behind OWC Ventures, which has not closed yet, but the team said it anticipates “raising a $20 million vehicle for pre-seed to Series A deals with co-investment opportunities.”