🗒️ Founder-Friendly Investors: How Private Equity and Venture Capital Are Helping Founders Level Up

Inc: WHETHER YOU NEED funding to help turn your startup into a successful business or to grow it into an industry leader, Inc.'s fourth annual Founder-Friendly Investors is a great place to start.

Since we last published this list, U.S. businesses have had to contend with record inflation, fears of a coming recession, and a Great Resignation that, uh, just won't quit. Finding an investment partner to help you handle these challenges could make the difference between your business gaining an edge or taking a turn for the worse. After all, private equity and venture capital firms don't fear change. They engineer it.

"If they bought the business, it's not to just keep doing more of the same," says Bob Gogel, a serial CEO and longtime consultant to entrepreneurs. "It's to do some new, innovative things." While investment activity in 2022 has fallen from record levels last year, the amount of capital going to U.S. businesses remains healthy historically. During the first half of the year, U.S. VC firms invested more than $144 billion across nearly 8,000 deals, according to research firm PitchBook.

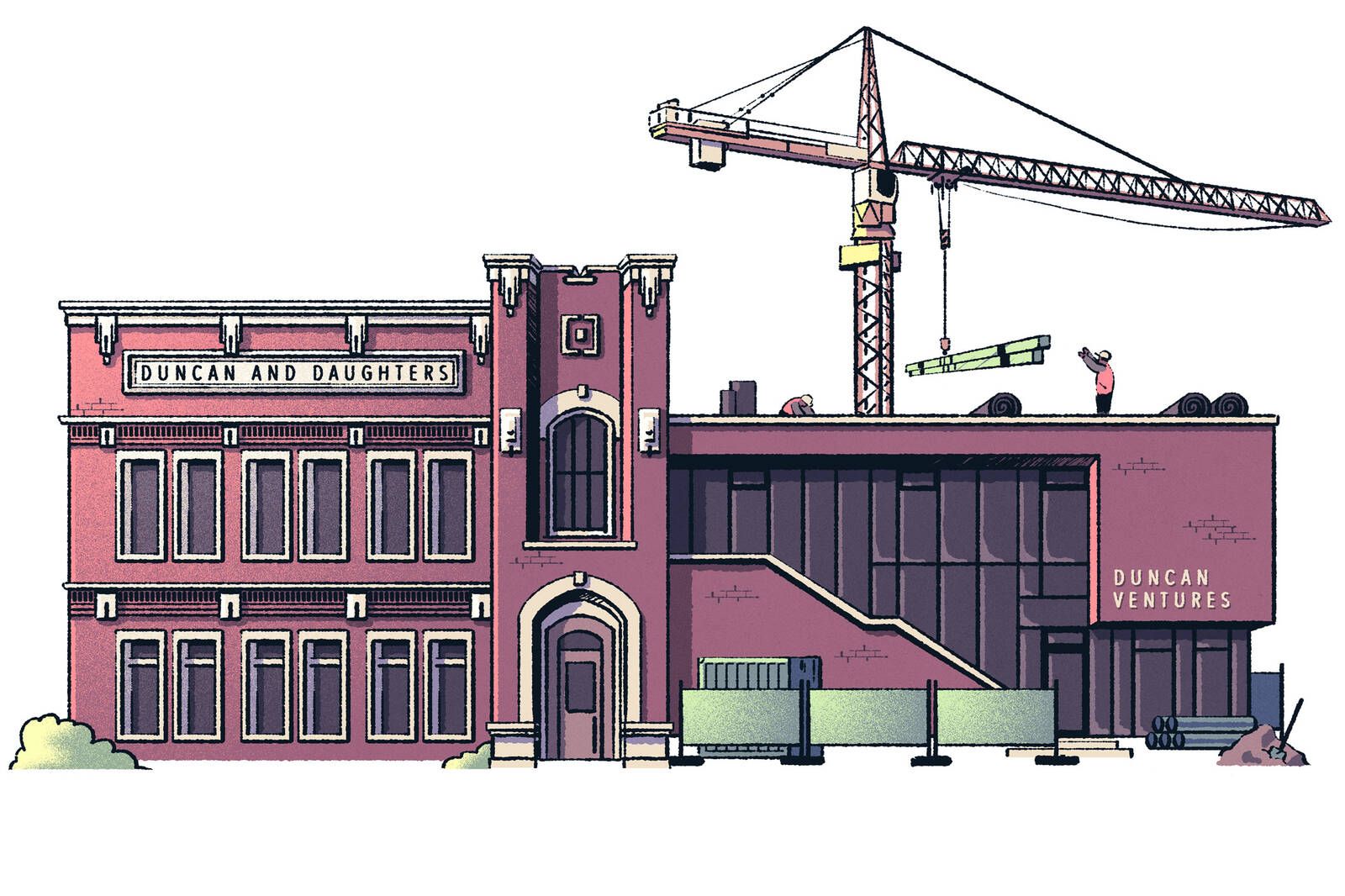

🗒️ Why More Family Enterprises Are “Venturing Out”

Kellog Insight: Family-owned businesses that have survived to the third generation and beyond are often characterized as risk-adverse capital preservers. Once wealth has been amassed, after all, there can be a natural tendency to protect rather than grow it.

Yet, in our experience working with later-stage business families at the John L. Ward Center for Family Enterprises, we are seeing something relatively new: family businesses creating venture-investing subsidiaries.

So why are families moving away from a wealth-preservation model to one that is far riskier—an industry in which just 25 percent of venture-backed firms can expect to succeed? And just as importantly, what does it take for family enterprises to do venture investing well?

Take On Risk to Mitigate Risk

For many family owners, part of the value proposition in venture investing is the opportunity to stay ahead of the competition. Families that want to remain in business for generations to come are thinking about how to be the disruptors instead of the disrupted.

John Thacher is a third-generation owner and board chair of the agricultural giant Wilbur-Ellis, which recently created a venture unit, Cavallo Ventures. In his view, venture investing offers a way to mitigate risk to the family’s core operating business. “We want to get under the covers to see what technologies are coming our way, and what level of disruption will accompany them,” he says. Only then can they adapt accordingly.

John Tracy, board chairman and CEO of Dot Family Holdings, maintains that Dot takes a similar view. The Tracy family, whose parents co-founded Dot Foods, recently purchased control over two early stage tech companies. They concluded that the startups were better positioned than internal teams to innovate quickly to solve some of the problems facing the core business. Some opportunities “require solutions that we can’t move fast enough on ourselves,” he says.

🗒️ Minority-Owned Managers in PE and Venture Capital Face

Barriers in Raising Their First Funds. Researchers Explore Why.

Institutional Investor: During fundraising, past performance metrics have a greater impact on Black- and Latino-owned private capital funds than on white-owned funds.

In fact, minority-owned venture capital and private equity buyout funds are more likely to be punished for past performance when fundraising for a second fund, according to a paper titled “Racial Diversity in Private Capital Fundraising” by Johan Cassel, an assistant professor of finance at Vanderbilt University, Josh Lerner, a professor at Harvard Business School, and Emmanuel Yimfor, an assistant professor of finance at the University of Michigan. This dynamic is indicative of larger investor biases toward minority-owned funds.

The asset management industry has little diversity. According to one of Lerner’s previous papers, in 2021 only about 1.4 percent of the total share of assets under management were managed by firms owned by minorities in the U.S., even though they represented 40 percent of the population last year. While the homogeneity of the asset management industry is widely known, the reasons for the lack of diversity are less clear. In the report, Cassel, Lener, and Yimfor explore possible explanations, focusing on venture capital, buyout, and growth investment firms. The report also notes that past research has found that investors have a tendency to fund entrepreneurs with which they share characteristics. As a result, minorities may face significant obstacles when starting a business, a significant source of wealth creation.

🗒️ In 2019 this VC decided to invest in diverse founders. Three years later it’s already starting a second fund

Techcrunch: It feels like an eon has passed since the launch in 2019 of Ada Ventures, a European VC that decided to invest in normally under-represented groups and sectors, like women or POC founders, as well as tech which improves society. Its $34 million (£27 million) fund was designed as a “first-cheque” seed fund.

Ada now says it’s reached a £36 million “first close” of its second fund. Sources say the fund is actually aiming for a £60 million final close.

Ada launched with a “scout network” designed specifically to go after under-represented founders.